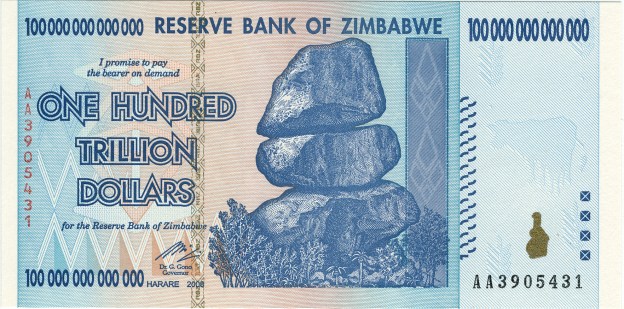

The Reserve Bank of Zimbabwe, which gained global notoriety in 2008 for printing one-hundred-trillion-dollar notes, said in April 2024 that it was launching a new national currency, promising, once again, to end years of monetary turbulence. John Mushayavanhu, who took over as the central bank’s new governor in April 2024 said the new unit, Zimbabwe Gold, or ZiG, will replace the current Zimbabwe dollar, which has lost around three-fourths of its value this year.

The currency most recently traded at more than 30,674 Zimbabwean dollars to the U.S. dollar, according to the central bank. When the bank relaunched the local unit in 2019, $1 bought 2.50 Zimbabwean dollars. Mushayavanhu said the new currency would initially be valued at 13.56 ZiGs for $1 and later at a rate determined by the market.

To shore up confidence in the currency, Mushayavanhu said it would be fully backed by Zimbabwe’s reserves of U.S. dollars and precious metals, particularly gold. He also pledged to end a long-running practice of the bank issuing more money to finance government spending…

Zimbabwe abolished the Zimbabwe dollar in 2009, after a bout of hyperinflation that, by some estimates, saw prices rise by 500 billion percent. For nearly a decade, the country then operated on U.S. dollars and other foreign currencies. When the central bank was no longer able to pay out savings in cash dollars, it reintroduced the Zimbabwe dollar in 2019.

Excerpt from Gabriele Steinhauser, Zimbabwe Launches a New Currency…Again, WSJ, April 5, 2024