Zimbabwe: Deflation has taken root as consumer demand shrinks and the economy struggles with a shortage of dollars. Once bustling factories in Harare are now rusty shells, devastated by the 1999-2008 recession that cut GDP by about half. In addition, the mines are reeling from the fall in commodity prices and a drought has left 16% of the population needing food aid. Formal unemployment stands at more than 80% and power shortages are getting worse…

A year ago, Mugabe, the President of Zimbabwe, turned to “old friend” China, but behind the official warmth Beijing made clear the days of blank cheques were over, forcing Zimbabwe to make repayments on $1 billion of loans made over the previous five years….

Zimbabwe has also opened talks on fresh loans from the World Bank, IMF and African Development Bank for the first time since 2009, when it started defaulting on its foreign debt, which now stands at $10.4 billion or 74% of GDP….

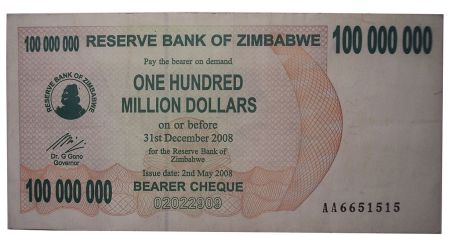

In the past, Mugabe parcelled out land seized from white commercial farmers, raised wages for state workers and printed money to finance government spending to shore up his support. Now he has little room to manoeuvre after the adoption of the US dollar in 2009. The government can no longer devalue the currency, print money to stimulate the economy or influence interest rates…

But new international loans will require reforms, including selling some loss-making state firms, which are a constant drain on the public purse, analysts said.Harare would need to plug leaks in its finances, increase transparency in mining revenue, redistribute idle farms to competent farmers and ease black economic empowerment laws requiring foreign-owned firms to sell majority shares to locals. “By far the biggest reform is that of the civil service. The government needs to cut spending on salaries, which the authorities are conscious of,” said a Western diplomat who has helped Harare in discussions with foreign creditors. Wages take up 83% of Zimbabwe’s $4 billion annual budget. Finance Minister Patrick Chinamasa has said the bill should be cut in half, but there is no consensus within cabinet on how to do it. The government is now the biggest employer with 550,000 workers of the total 800,000 formal jobs. Most Zimbabweans earn a living in the informal sector and on the streets.

Excerpts from Zimbabwe’s Mugabe warms to the West as economy wobbles, Reuters, Oct. 22, 2015