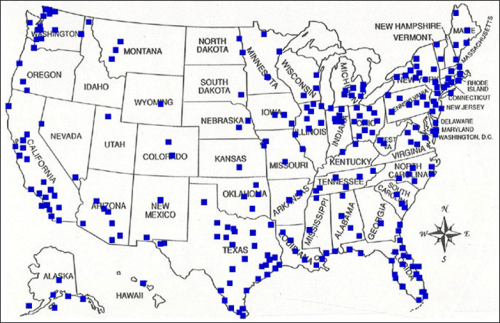

SKU Distribution in Mesa, Arizona., is experiencing rapid growth as companies seek to access foreign-trade zones and navigate rising U.S. tariffs. Companies can use foreign-trade zones to defer tariff payments until products are sold, which operators say helps them manage supply chains and avoid bottlenecks. The foreign-trade zone program dates back to the 1930s, with roughly 260 such facilities now in the U.S. In some, inquiries from companies have recently quadrupled.

SKU Distribution had just one customer in 2024 at its Mesa, Arizona, warehouse. In 2025, it is teeming with new business from companies storing items such as aluminum poles, ice picks, carabiners and firearm safes. That is because the warehouse is the ultimate U.S.-based tariff refuge…

Arizona is the foreign-trade zone capital of America, its facilities employing more workers than those of any other state, Commerce Department data shows. Apple, Intel, Honeywell Aerospace, Sub-Zero and Ball Corp. all manufacture within the Arizona facilities, together processing more than $7.5 billion in merchandise in 2023. The program has helped turn this strip of the Phoenix-area desert into a chip-making hot spot. Now, Trump’s tariffs are drawing a clientele of smaller companies looking for refuge from the trade war.

Excerpt from Owen Tucker-Smith, Inside the Arizona Warehouse That Has Become Shelter in Tariff Storm, WSJ, May 12, 2025

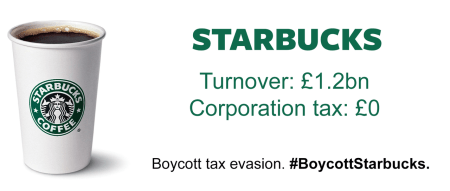

See also United States as a Tax Haven