Taiwan Semiconductor Manufacturing Co (TSMC) has emerged over the past several years as the world’s most important semiconductor company, with enormous influence over the global economy. With a market cap of around $550 billion, it ranks as the world’s 11th most valuable company. Its dominance leaves the world in a vulnerable position, however. As more technologies require chips of mind-boggling complexity, more are coming from this one company, on an island that’s a focal point of tensions between the U.S. and China, which claims Taiwan as its own.

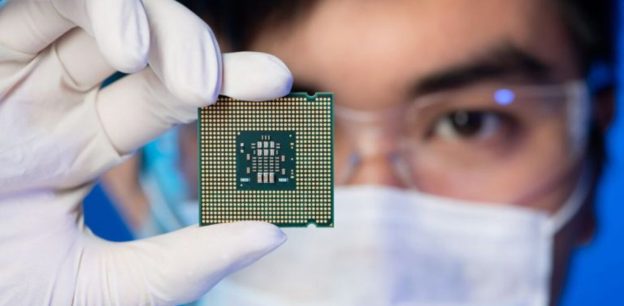

The situation is similar in some ways to the world’s past reliance on Middle Eastern oil, with any instability on the island threatening to echo across industries….Being dependent on Taiwanese chips “poses a threat to the global economy,” research firm Capital Economics recently wrote. Its technology is so advanced, Capital Economics said, that it now makes around 92% of the world’s most sophisticated chips, which have transistors that are less than one-thousandth the width of a human hair. Samsung Electronics Co. makes the rest.

The U.S., Europe and China are scrambling to cut their reliance on Taiwanese chips. While the U.S. still leads the world in chip design and intellectual property with homegrown giants like Intel Corp. , Nvidia Corp. and Qualcomm, it now accounts for only 12% of the world’s chip manufacturing, down from 37% in 1990, according to Boston Consulting Group. President Biden’s infrastructure plan includes $50 billion to help boost domestic chip production. China has made semiconductor independence a major tenet of its national strategic plan. The European Union aims to produce at least 20% of the world’s next-generation chips in 2030 as part of a $150 billion digital industries scheme.

The Taiwanese maker has also faced calls from the U.S. and Germany to expand supply due to factory closures and lost revenues in the auto industry, which was the first to get hit by the current chip shortage.

Semiconductors have become so complex and capital-intensive that once a producer falls behind, it’s hard to catch up. Companies can spend billions of dollars and years trying, only to see the technological horizon recede further. A single semiconductor factory can cost as much as $20 billion. One key manufacturing tool for advanced chip-making that imprints intricate circuit patterns on silicon costs upward of $100 million, requiring multiple planes to deliver…

Taiwanese leaders refer to the local chip industry as Taiwan’s “silicon shield,” helping protect it from such conflict. Taiwan’s government has showered subsidies on the local chip industry over the years, analysts say.

Excerpts from Yang Jie et al., The World Relies on One Chip Maker in Taiwan, Leaving Everyone Vulnerable, WSJ, June 19, 2021