Animal diseases, the US-China trade war and covid-19 have all disrupted, or threatened to disrupt, industrial chicken supplies and supply chains…The unsentimental logic of high-performance poultry-rearing is easy to grasp. “White-feather meat chickens”, as they are known in China, grow to 2.5kg in 40 days. Homegrown varieties of “yellow-feather chicken”, descended from backyard fowl, take twice as long to mature and will only ever weigh half as much…

Half a century ago meat in China was a rare luxury. Now, many see it as a daily necessity. In the meantime, the country’s supplies of farmland and clean water have not grown. Agriculture remains blighted by food-safety scandals, the rampant use of fake or illegal animal medicines, and disease outbreaks. Small surprise, then, that Chinese leaders give frequent speeches about food security. A puzzle lurks, though. Leaders also call for self-reliance in key technologies. And in the case of broiler chickens, those two ambitions—rearing meat efficiently and avoiding dependence on imports—are in tension.

The chicken imported into China are the fifth-generation descendants of pedigree birds whose bloodlines represent 80 years of selection for such traits as efficient food-to-meat conversion, rapid growth, strong leg bones and disease resistance. After waves of consolidation, the industry is dominated by two firms, Aviagen (based in Alabama and owned by the ew Group of Germany) and Cobb (owned by Tyson, an American poultry giant).

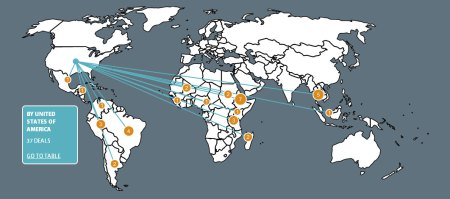

The most valuable pedigree birds never leave maximum-security farms in America and Britain: a single pedigree hen may generate 4m direct descendants. Their second-generation offspring are flown to breeding sites dispersed between such places as Brazil, Britain and New Zealand, in part to hedge against supply shocks when avian influenzas and other diseases close borders. Day-old third-generation chicks are air-freighted to Jinghai Poultry, a company in China, and other places, which spend six months growing them and breeding them in climate-controlled, artificially lit indoor facilities. In all, China imports 1.6m third-generation white-feather chicks a year.

Jinghai Poultry hatches 8m fourth-generation, “parent stock” chickens annually. The company sells some to other agri-businesses. It breeds from the rest to produce fifth-generation chicks. These are “meat chickens”, consumed in fast-food outlets, schools and factory canteens, or as chicken parts sold in supermarkets. Yellow-feather chickens, deemed tastier by Chinese cooks, account for most whole birds sold in markets.

Chinese breeders have long tried to create local varieties with bloodlines available in-country… In September 2019, the State Council, China’s cabinet, issued a paper on livestock-rearing that set self-sufficiency in poultry as a goal, calling meat-chicken breeding a priority. Big foreign firms have resisted appeals from officials to send second-generation stock to China….Dependence on foreign bloodlines does carry risks. For several months recently New Zealand was one of the only countries able to send third-generation chicks to China, after other exporters suffered bird-flu outbreaks.

Li Jinghui, president of the China Broiler Alliance, an industry association, calls conditions ripe for China’s “brilliant” scientists to develop local birds… But to develop a domestic breed from scratch would take years, and if it does not meet market needs, a firm could spend a fortune “without much to show for it”…Without a stronger animal-health system and environmental controls, biotechnology alone cannot help China to develop world-class agriculture. Moreover, a long-standing Chinese strategy—bullying foreign firms to hand over intellectual property—is counter-productive now.

Excerpts from High-tech chickens are a case study of why self-reliance is so hard, Economist, Oct. 31, 2020