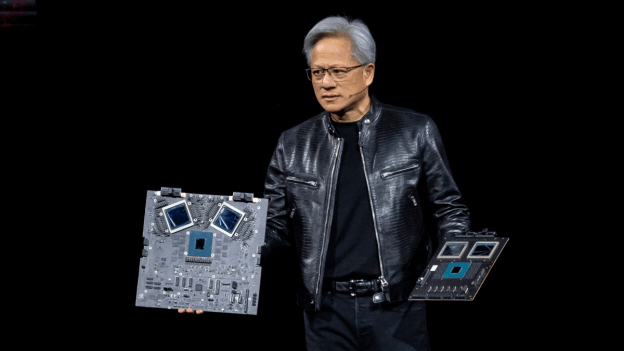

Chinese artificial-intelligence developers have found a way to use the most advanced American chips without bringing them to China. They are working with brokers to access computing power overseas, sometimes masking their identity using techniques from the cryptocurrency world. The tactic comes in response to U.S. export controls that have prevented Chinese companies from directly importing sought after AI chips developed by U.S.-based Nvidia. While it is still possible for Chinese users to physically bring Nvidia’s chips to China by tapping a network of gray-market sellers, the process is cumbersome and can’t supply all the needs of big users.

One entrepreneur helping Chinese companies overcome the hurdles is Derek Aw, a former bitcoin miner. He persuaded investors in Dubai and the U.S. to fund the purchase of AI servers housing Nvidia’s powerful H100 chips. In June 2024, Aw’s company loaded more than 300 servers with the chips into a data center in Brisbane, Australia. Three weeks later, the servers began processing AI algorithms for a company in Beijing. “There is demand. There is profit. Naturally someone will provide the supply,” Aw said.

Renting far away computing power is nothing new, and many global companies shuffle data around the world using U.S. companies’ services such as Google Cloud, Microsoft Azure and Amazon Web Services. However, those companies, like banks, have “Know Your Customer” policies that may make it difficult for some Chinese customers to obtain the most advanced computing power.

The buyers and sellers of computing power and the middlemen connecting them aren’t breaking any laws, lawyers familiar with U.S. sanctions say. Washington has targeted exports of advanced chips, equipment and technology, but cloud companies say the export rules don’t restrict Chinese companies or their foreign affiliates from accessing U.S. cloud services using Nvidia chips. The Commerce Department in January 2014 proposed a rule that seeks to prevent malicious foreign entities from using U.S. cloud computing services for activities including training large AI models. U.S. cloud companies argue that the rule won’t prevent abuse and could instead undermine customer trust and weaken their competitiveness.

In platforms used by Aw and others, the billing and payment methods are designed to give the participants a high degree of anonymity. Buyers and sellers of computing power use a “smart contract” in which the terms are set in a publicly accessible digital record book. The parties to the contract are identified only by a series of letters and numbers and the buyer pays with cryptocurrency. The process extends the anonymity of cryptocurrency to the contract itself, with both using the digital record-keeping technology known as blockchain. Aw said even he might not know the real identity of the buyer. As a further mask, he and others said Chinese AI companies often make transactions through subsidiaries in Singapore or elsewhere.

The service of selling scattered computing power is called a decentralized GPU model.

Excerpts from Raffaele Huang, China’s AI Engineers Are Secretly Accessing Banned Nvidia Chips, WSJ, Aug. 26, 2024