Lithium Americas, a Canadian company, has plans to build a mine and processing plant at Thacker Pass, near the southern tip of the caldera in Nevada. It would be America’s biggest lithium mine. Ranchers and farmers in nearby Orovada, a town of about 120 people, worry that the mine will threaten their water supply and air quality. Native American tribes in the region say they were not properly consulted before the Bureau of Land Management (BLM), a federal agency that manages America’s vast public lands, decided to permit the project. Tribes also allege that a massacre of their ancestors took place at Thacker Pass in 1865…

The fight over Thacker Pass is not surprising. President Joe Biden wants half of all cars sold in 2030 to be electric, and to reach net-zero emissions by 2050. These ambitious climate targets mean that battles over where and how to mine are coming to mineral-rich communities around the country. America is in need of cobalt, copper and lithium, among other things, which are used in batteries and other clean-energy technologies. As with past commodity booms, large deposits of many of these materials are found in America’s western states . America, of course, is not the only country racing to secure access to such materials. As countries pledge to go carbon-free, global demand for critical minerals is set to soar. The International Energy Agency, a forecaster, estimates that by 2040 demand for lithium could increase by more than 40 times relative to 2020. Demand for cobalt and nickel could grow by about 20 times in the same period.

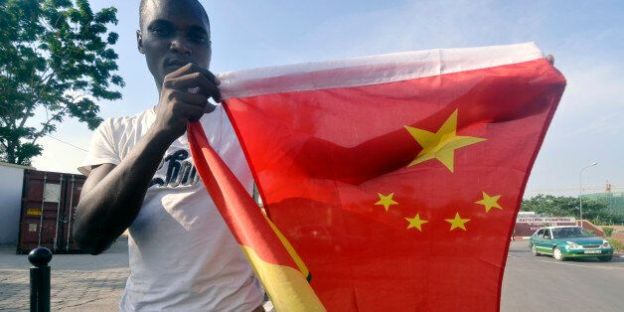

Beyond its green goals, America is also intent on diversifying mineral supplies away from China and Russia (big producer of nickel), which—by virtue of its natural bounty and muscular industrial policy—has become a raw-materials juggernaut… The green transition has also turned the pursuit of critical minerals into a great-power competition not unlike the search for gold or oil in eras past. Mining for lithium, the Department of Energy (DOE) says, is not only a means of fighting climate change but also a matter of national security.

Westerners have seen all this before, and are wary of new mines…The economic history of the American West is a story of boom and bust. When a commodity bubble burst, boomtowns were abandoned. The legacy of those busts still plagues the region. In 2020 the Government Accountability Office estimated that there could be at least 530,000 abandoned hardrock-mine features, such as tunnels or waste piles, on federal lands. At least 89,000 of those could pose a safety or environmental hazard. Most of America’s abandoned hardrock mines are in 13 states west of the Mississippi River…

Is it possible to secure critical minerals while avoiding the mistakes of previous booms? America’s debates over how to use its public lands, and to whom those lands belong, are notoriously unruly. Conservationists, energy companies, ranchers and tribal nations all feel some sense of ownership. Total harmony is unlikely. But there are ways to lessen the animosity.

Start with environmental concerns. Mining is a dirty business, but development and conservation can coexist. In 2020 Stanford University helped broker a national agreement between the hydropower industry and conservation groups to increase safety and efficiency at existing dams while removing dams that are harming the environment….Many worry that permitting new development on land sacred to tribes will be yet another example of America’s exploitation of indigenous peoples in pursuit of land and natural resources. msci, a consultancy, reckons that 97% of America’s nickel reserves, 89% of copper, 79% of lithium and 68% of cobalt are found within 35 miles of Native American reservations.

TThe BLM is supposed to consult tribes about policies that may affect the tribes but the consultation process is broken. Often it consists of sending tribes a letter notifying them of a mining or drilling proposal.

Lithium Americas has offered to build the town a new school, one that will be farther away from a road that the firm will use to transport sulphur. Sitting in her truck outside a petrol station that doubles as Orovada’s local watering hole, Ms Amato recalled one group member’s response to the offer: “If all I’m going to get is a kick in the ass, because we’re getting the mine regardless, then I may as well get a kick in the ass and a brand new school.”

Excerpt from America’s Next Mining Boom: Between a Rock and a Hard Place, Economist, Feb. 19, 2022