Teeming with underground riches, Greenland might set the scene for a modern gold rush. President Trump, for one, covets Greenland’s deposits of critical minerals, some of the largest in the Western Hemisphere. But as the visiting Australian company, Energy Transition Minerals, has discovered, securing them is a daunting task.

Kvanefjeld, the site of the billion-year-old solidified magma in the mountains above the town of Narsaq, contains an estimated 1 billion tons of minerals, enough to potentially transform the global market for rare-earth elements, used in such things as electric vehicles, jet fighters, wind turbines and headphones.

Mining companies in Greenland operate in one of the most challenging environments in the world because of the Danish territory’s sparse infrastructure, hostile weather and a tricky political climate. Mining here is expensive, and few investors are willing to pay for it given the uncertainties. Despite its extraordinary mineral wealth, Greenland has only two active mines: a gold mine in commissioning phase and a mine producing anorthosite, used in fiberglass, paints and other construction materials…“Investing in Greenland is not for the faint of heart,” said Brian Hanrahan, chief executive officer of Lumina Sustainable Materials, which operates the anorthosite mine on the west coast of Greenland. “The local logistics are incredibly complex.” Building a mine involves high startup costs, and has to be done from scratch in rugged terrain. Greenland is nearly one-fourth the size of the U.S., and about 80% of it is covered by ice, with deep fjords and ice sheets up to a mile thick. There are no roads between settlements, and shipping is treacherous because of floating ice off the coast.

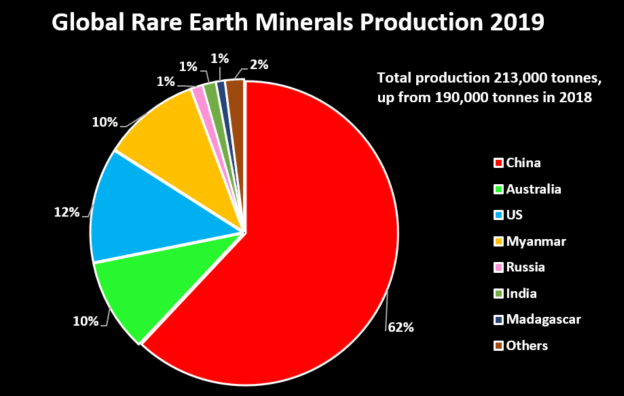

Bureaucracy is a hindrance, too. The process of granting licenses to foreign companies to mine is lengthy and cumbersome. While applying for licenses, companies need to keep employees on payroll with benefits. With a population of 57,000, Greenland’s labor market is tight…Extracting Greenland’s minerals is about more than profit; it is about resource control. Western governments are eager to break China’s dominance of the global market for rare earths and other minerals, which it could wield as a weapon in a trade war…“Greenland is host to some of the largest rare-earth resources known to exist globally, which have potential to supply virtually all the foreseeable needs of North America and Europe for decades to come,” said Ryan Castilloux, managing director of Adamas Intelligence… ‘

But when directors from Energy Transition Minerals visited Narsaq in February 2025, they were met near the icy helipad by protesters in brightly colored vests emblazoned with a logo spelling “Uranium? No, Thank You” in Greenlandic…Many among the Inuit population of Narsaq are concerned about contamination of drinking water, plants and wildlife. “We live off nature as our forefathers have done for generations. We will be forced to move,” said Avaaraq Bendtsen, a 25-year-old archaeology student. “Think about the indigenous people as well. This is our land. It is our mountain.”

Excerpts from Sune Engel Rasmussen, Greenland Has the Makings of a Mining Boom. So Where Is Everyone?, WSJ, Mar. 4, 2025